In the world of personal finance, few strategies offer as direct a path to saving money as refinancing a loan. Whether you have a mortgage, a car loan, or a personal loan, the terms you agreed to months or years ago may no longer be the best deal available. Interest rates fluctuate, and your own financial situation can improve dramatically. Refinancing offers a powerful opportunity to replace your existing loan with a new one that has more favorable terms, potentially saving you thousands of dollars over the life of the loan.

This comprehensive guide is designed for the everyday consumer. We’ll break down the complexities of refinancing into simple, actionable steps. You’ll learn how it works, when it makes sense, what pitfalls to avoid, and how to navigate the process for different types of loans to put more money back in your pocket.

What Exactly is Refinancing and How Does It Work?

At its core, refinancing is the process of taking out a new loan to pay off one or more of your existing loans. The new loan ideally comes with better terms, which can mean a variety of benefits for you, the borrower. Think of it as trading in your old, more expensive loan for a new, cheaper one.

The mechanics are straightforward:

- You apply for a new loan from either your current lender or a new one.

- The lender assesses your current creditworthiness and financial health.

- If approved, the new lender pays off your original loan in full.

- You begin making monthly payments on the new loan under the new terms.

The primary goal for most people is to save money, but as we’ll see, there are several ways refinancing can help you achieve your financial objectives.

The Golden Question: When Should You Consider Refinancing?

Refinancing isn’t the right move for everyone, and timing is critical. Several key indicators can signal that it’s a good time to explore your options.

Interest Rates Have Dropped Significantly

This is the most common and compelling reason to refinance. If market interest rates have fallen since you first took out your loan, you may be able to lock in a new, lower rate. A reduction of even 1% on a large loan, like a mortgage, can translate into substantial savings each month and tens of thousands of dollars over the loan’s term.

Your Credit Score Has Improved Substantially

When you first got your loan, your interest rate was heavily influenced by your credit score. If you’ve spent the last few years making on-time payments, reducing your credit card balances, and generally improving your credit health, your score has likely increased. A higher credit score makes you a less risky borrower in the eyes of lenders, which means you can qualify for much better interest rates than you could before.

You Want to Change Your Loan Term

Refinancing isn’t just about the interest rate. It’s also an opportunity to adjust the length of your loan.

- Shortening the Term: You might refinance from a 30-year mortgage to a 15-year mortgage. Your monthly payment will likely increase, but you’ll pay significantly less in total interest and own your home free and clear much sooner.

- Lengthening the Term: If your monthly budget is tight, refinancing to a longer term can reduce your monthly payments, freeing up cash flow for other needs. Be aware that while this provides immediate relief, you will likely pay more in total interest over the life of the longer loan.

You Need to Tap Into Your Home’s Equity

For homeowners, a “cash-out refinance” is a popular option. This involves taking out a new mortgage for more than you currently owe and receiving the difference in cash. This can be a strategic way to fund major expenses like home renovations, college tuition, or to consolidate high-interest debt, often at a lower interest rate than other forms of credit.

Before You Leap: Calculating the True Cost of Refinancing

While the promise of a lower monthly payment is alluring, refinancing is not free. It’s crucial to do the math to ensure the long-term savings outweigh the upfront costs.

Understanding Closing Costs

Just like with your original loan, refinancing involves closing costs. These can include:

- Application Fee: Covers the cost of processing your application.

- Loan Origination Fee: A charge from the lender for creating the loan.

- Appraisal Fee: To determine the current market value of your property (for mortgages).

- Title Insurance and Search Fees: To ensure there are no other claims on the property.

- Attorney and Notary Fees: For preparing and witnessing the legal documents.

Typically, these costs range from 2% to 5% of the new loan amount. So, on a $200,000 refinance, you could be looking at costs between $4,000 and $10,000.

The All-Important Break-Even Point

To determine if refinancing is financially sound, you must calculate your break-even point. This is the point in time when your monthly savings have completely covered the closing costs.

The formula is simple:

Break-Even Point (in months) = Total Closing Costs / Monthly Savings

Example:

- Total Closing Costs: $5,000

- Monthly Savings from New Loan: $200

- Break-Even Point: $5,000 / $200 = 25 months

In this scenario, it would take you 25 months to recoup the cost of refinancing. If you plan to stay in your home or keep your car for longer than that, refinancing is likely a smart financial move. If you might sell before then, you would lose money on the transaction.

Your Step-by-Step Guide to the Refinancing Process

Feeling ready to move forward? Here’s a breakdown of the typical steps you’ll take to refinance your loan.

Step 1: Define Your Refinancing Goal

Before you even look at lenders, clarify what you want to achieve. Are you aiming for the lowest possible monthly payment? Do you want to pay off your loan faster? Are you trying to get cash out? Your goal will determine the type of loan and term you should be looking for.

Step 2: Check Your Credit Score and Report

Your credit score is the key that unlocks the best interest rates. Get a free copy of your credit report from all three major bureaus (Equifax, Experian, and TransUnion) via AnnualCreditReport.com. Scrutinize them for any errors that could be dragging down your score and dispute them if necessary.

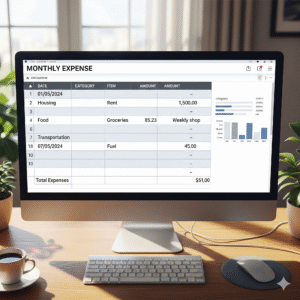

Step 3: Gather Your Financial Documents

Lenders will need to verify your financial situation. Get your paperwork in order ahead of time. This typically includes:

- Recent pay stubs

- W-2s from the last two years

- Federal tax returns

- Statements for bank and investment accounts

- Information on your current loan

Step 4: Shop Around for the Best Lenders

Do not take the first offer you receive. Compare rates and terms from a variety of lenders, including:

- Your current lender

- National banks

- Local credit unions

- Online lenders

Get at least three to four quotes to ensure you’re getting a competitive deal. Pay close attention to the Annual Percentage Rate (APR), which includes both the interest rate and the lender’s fees, giving you a more accurate picture of the loan’s total cost.

Step 5: Submit Your Application and Lock in Your Rate

Once you’ve chosen a lender, you’ll complete a formal application. After your application is provisionally approved, you’ll have the option to “lock in” your interest rate. A rate lock protects you from any market fluctuations while your loan is being processed, which can take several weeks.

Step 6: The Underwriting and Closing Process

This is the final stretch. The lender’s underwriting department will review all your documentation and, for a mortgage, conduct an appraisal. Once everything is verified, you will schedule a closing. At the closing, you will sign the final loan documents. Within a few days, your new lender will pay off your old loan, and your new payment schedule will begin.

Refinancing Different Types of Loans: What You Need to Know

While the general process is similar, there are nuances to refinancing different kinds of debt.

How to Refinance Your Mortgage

This is often the most impactful type of refinancing due to the large loan amounts.

- Key Consideration: The break-even point is paramount. Given the high closing costs, you need to be sure you’ll stay in the home long enough to realize the savings.

- Special Option: Cash-Out Refinancing. As mentioned, this allows you to tap into your home equity. It’s a powerful tool but increases your overall mortgage debt. Use the cash wisely for investments that add value (like home improvements) or to eliminate higher-interest debt.

How to Refinance Your Auto Loan

Refinancing a car loan is typically a faster and simpler process with much lower (or even no) fees.

- Key Consideration: Check for prepayment penalties on your existing loan. Also, ensure the car’s value isn’t “upside-down” (meaning you owe more than the car is worth), as lenders are hesitant to refinance in that situation.

- Best Time to Act: If your credit has improved or rates have dropped since you bought your car, a quick refinance can lower your monthly payment and save you hundreds or even thousands over the remaining term.

How to Refinance a Personal Loan

This is a great strategy to consolidate high-interest debt or simply get a better rate on an existing personal loan.

- Key Consideration: The process is very similar to applying for a new personal loan. Lenders will focus heavily on your credit score and debt-to-income ratio.

- Debt Consolidation: If you have multiple high-interest debts (like credit cards), refinancing them into a single personal loan with a lower fixed interest rate can simplify your payments and help you pay off the debt faster.

Potential Risks and Pitfalls to Avoid

Refinancing can be a fantastic financial tool, but it’s essential to be aware of the potential downsides.

- Resetting the Clock: When you refinance to a new 30-year mortgage, you’re starting the clock over again. Even with a lower interest rate, you could end up paying more in total interest over the long haul if you’ve already been paying on your original loan for several years.

- Prepayment Penalties: Some original loans have a clause that charges you a fee if you pay the loan off early. Make sure this penalty doesn’t negate the savings from refinancing.

- The Temptation of Cash-Outs: Using a cash-out refinance for frivolous spending or luxury items is a dangerous game. You are turning unsecured debt (like a credit card balance) into secured debt backed by your home, putting you at risk of foreclosure if you can’t make the payments.

By carefully considering your goals, doing the math, and shopping for the best deal, you can successfully navigate the refinancing process. It’s a strategic financial maneuver that, when done correctly, can lower your monthly bills, accelerate your debt repayment, and free up your money for the things that matter most.